PM Youth Loan Scheme 2025 – Easy & Proven Method to Get Loan Online and Start Your Business

If you’re a young Pakistani with a business dream but no capital, the PM Youth Loan Scheme 2025 might be exactly what you need. Whether you want to open a shop, launch a startup, or expand your agricultural work, this government-backed loan program offers easy financing with low or zero markup—and the entire process is online.

Thousands of young entrepreneurs have already benefited from this initiative. Now it’s your turn to take the leap toward financial independence.

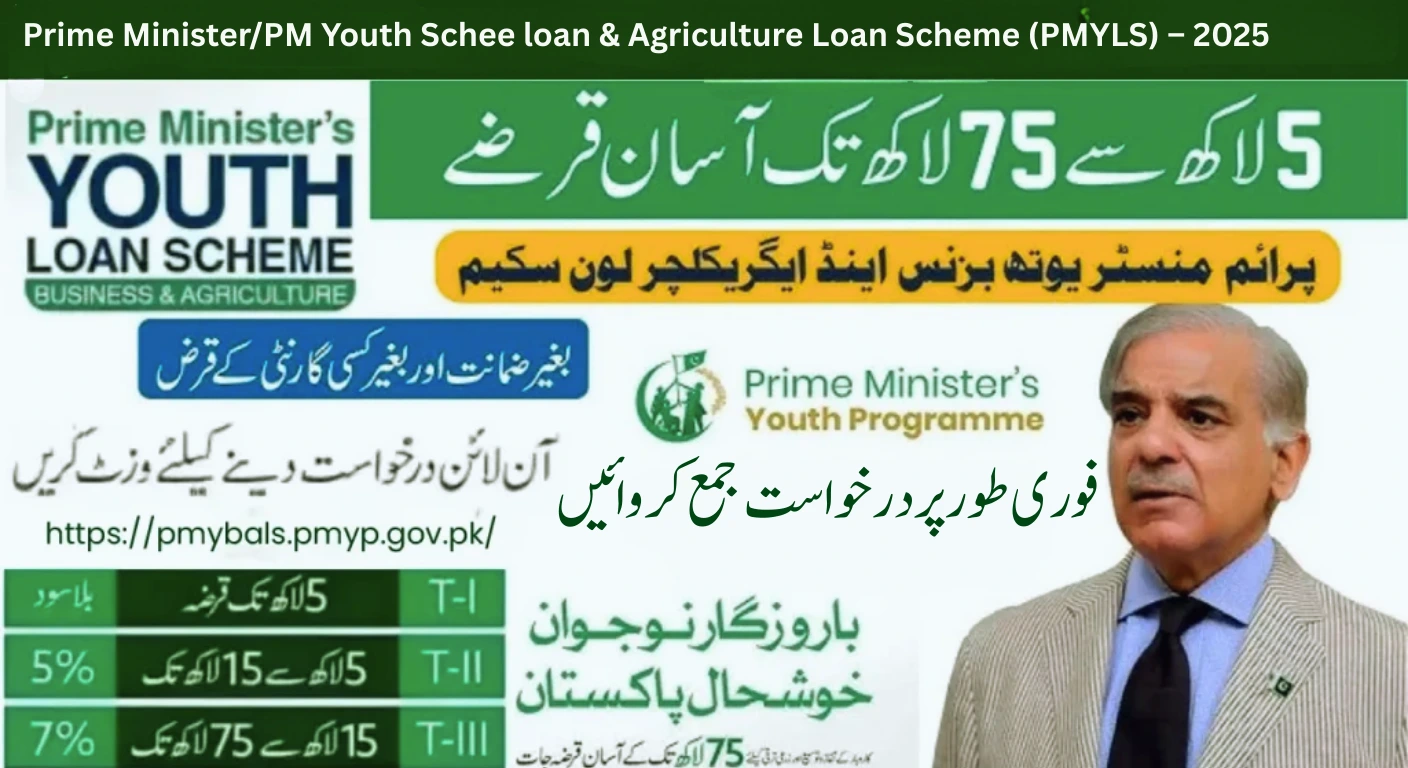

Quick Summary – PM Youth Loan Scheme 2025

| Feature | Details |

| Scheme Name | PM Youth Business & Agriculture Loan Scheme |

| Launch Year | 2025 |

| Age Limit | 21–45 years (18+ for IT/E-commerce) |

| Loan Tiers | Tier 1, Tier 2, Tier 3 |

| Loan Amount Range | Rs. 0.5 million to Rs. 7.5 million |

| Markup Rate | 0% to 7% depending on tier |

| Application Mode | Online via Digital Youth Hub |

| Status Check | Online tracking via portal |

| Quota | 25% for women, 5% for differently-abled |

What Is the PM Youth Loan Scheme?

The PM Youth Loan Scheme 2025—officially known as the Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS)—is designed to promote entrepreneurship among Pakistan’s youth. It provides interest-free or low-interest loans through 15 commercial, Islamic, and SME banks across the country.

The scheme is part of the government’s broader effort to reduce unemployment, support small businesses, and empower young people to become job creators instead of job seekers.

Loan Tiers & Markup Rates

The scheme offers three loan tiers based on your business needs:

Tier 1 – Micro Startups

- Loan Amount: Up to Rs. 500,000

- Markup: 0%

- Repayment Period: Up to 3 years

- Ideal for: Freelancers, small shops, home-based businesses

Tier 2 – Growing Enterprises

- Loan Amount: Rs. 500,001 to Rs. 1.5 million

- Markup: 5%

- Repayment Period: Up to 5 years

- Ideal for: Retail stores, service providers, small manufacturers

Tier 3 – Established Businesses

- Loan Amount: Rs. 1.5 million to Rs. 7.5 million

- Markup: 7%

- Repayment Period: Up to 8 years

- Ideal for: Agriculture, logistics, tech startups, exporters

Who Can Apply?

To qualify for the PM Youth Loan Scheme 2025, you must:

- Be a Pakistani citizen aged 21–45

- Have a valid CNIC

- Present a business plan or idea

- Not be a government employee

- For IT/E-commerce businesses, minimum age is 18 years

There’s no minimum education requirement, but relevant qualifications or certifications can strengthen your application.

How to Apply Online – Step-by-Step Guide

Applying is simple and fully digital:

- Visit the Digital Youth Hub Portal

- Click on “Apply for Loan”

- Create an account using your CNIC and mobile number

- Fill out the application form with personal and business details

- Upload required documents (CNIC, photo, business plan, etc.)

- Submit and receive a tracking ID

You can also use the Loan Calculator on the portal to estimate your monthly payments.

Required Documents

Before applying, make sure you have:

- CNIC copy

- Passport-size photo

- Business plan or feasibility report

- Proof of residence

- Educational or professional certificates (if applicable)

Real-Life Success Story

Adeel from Sargodha, a 24-year-old graduate, applied under Tier 1 to launch a mobile repair shop. With Rs. 400,000 in funding and zero markup, he bought tools, rented a shop, and hired one assistant. “I used to wait for jobs. Now I run my own business,” he says proudly.

Farzana from Sukkur, a widow with tailoring skills, received Rs. 600,000 under Tier 2. She expanded her home-based stitching unit and now supplies uniforms to local schools.

How to Check Your Loan Status

Once you’ve applied, you can track your application:

- Go to the Digital Youth Hub Portal

- Click on “Track Application”

- Enter your CNIC and tracking ID

- View your application status, bank response, and approval timeline

You’ll also receive SMS and email updates throughout the process.

Partner Banks

Loans are disbursed through 15 banks, including:

- National Bank of Pakistan (NBP)

- Bank of Punjab (BOP)

- Habib Bank Limited (HBL)

- Meezan Bank

- UBL, Askari Bank, and others

You can select your preferred bank during the application process.

❓ FAQs – PM Youth Loan Scheme 2025

Conclusion:

The PM Youth Loan Scheme 2025 is more than just a financial program—it’s a gateway to independence, innovation, and impact. With flexible loan tiers, low markup, and a fully online process, it’s never been easier to turn your business idea into reality.

If you’re ready to take control of your future, don’t wait. Apply today, track your status, and start building the life you’ve always dreamed of. Whether you’re in a village or a city, this scheme is designed to empower you.

Also Read: Act Now! Asaan Karobar Finance Scheme 2025 – Apply Online Today & Last Date